Counder Conference 2026 will bring 500 hand-selected global business leaders to Cape Town for a three-day gathering focused on emerging markets and international collaboration. In a recent CNBC Africa interview, Counder co-founder Michel Weiss explained how the invitation-only conference creates trusted environments for meaningful conversations between international investors and African leaders, designed to foster partnerships and drive foreign direct investment. The event positions Cape Town as a world-class destination for global business discussions, featuring prominent figures from finance, technology, and sports investment sectors.

Read Full ArticleConnecting Visionary Leaders to collaborate on tomorrow’s most important opportunities.

Be Part of CounderA collective of visionary investors, entrepreneurs, CEOs, academics, and global influencers from finance, technology, the arts, and beyond, united by a forward-thinking mindset and a passion for collaboration.

We build trusted relationships that spark meaningful partnerships, co-investments, philanthropy, and purposeful innovation.

Jointly with our members and selected world-class organisations, we enable global innovation—transforming ambitious ideas into purpose-driven, profitable outcomes.

A Home for Visionary Leaders

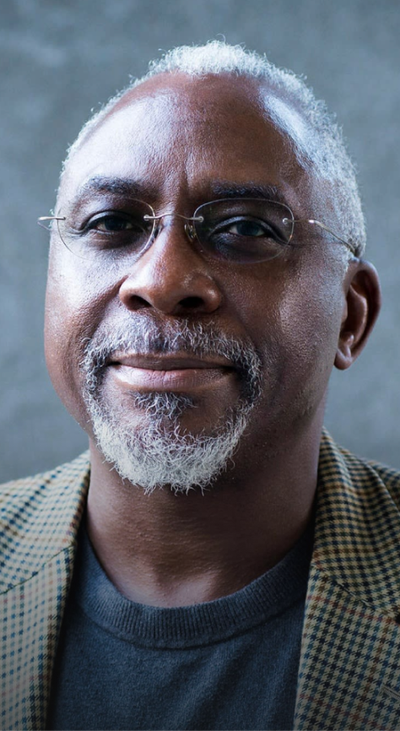

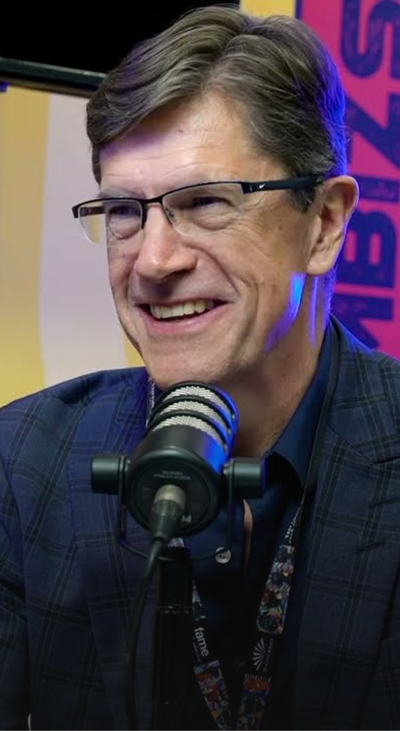

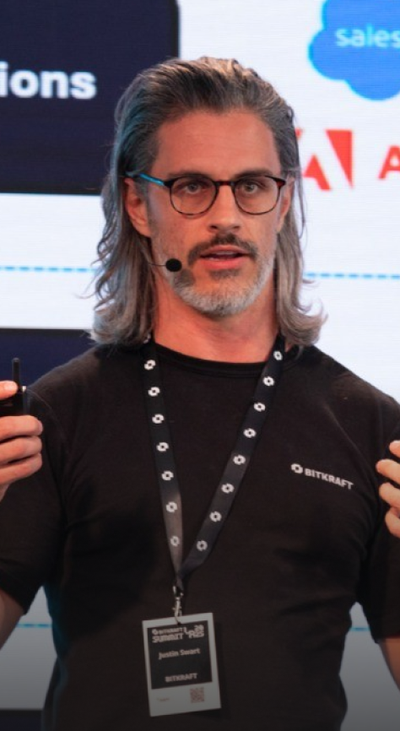

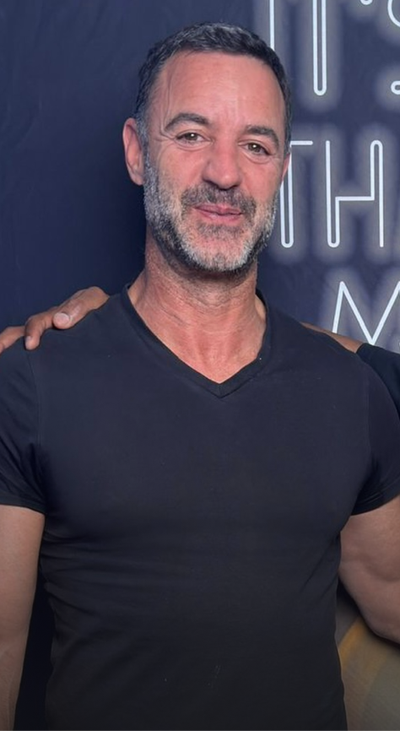

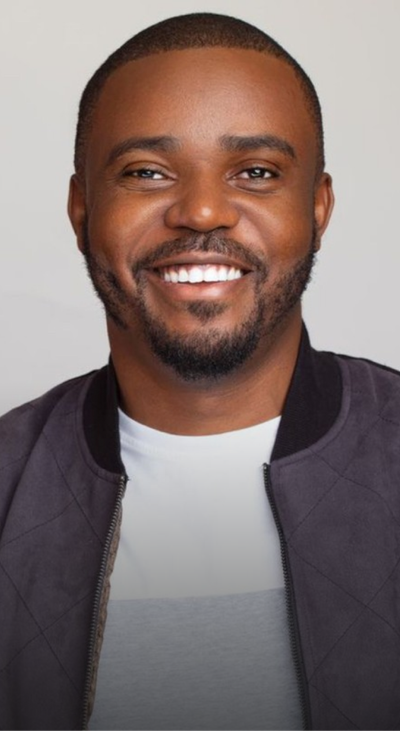

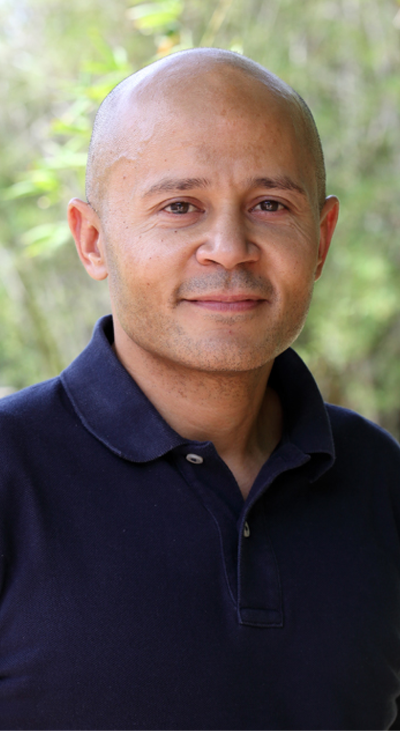

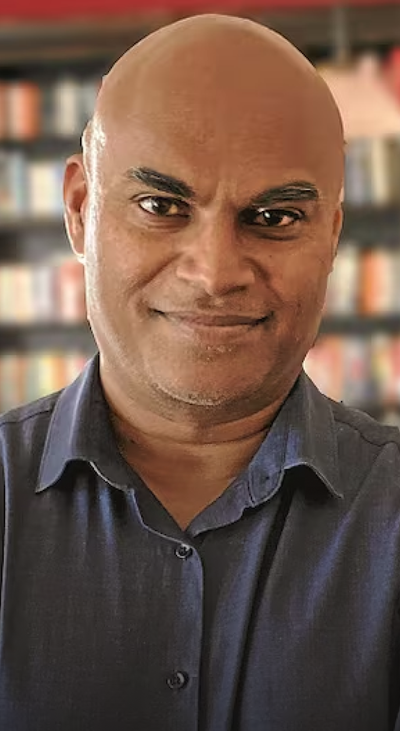

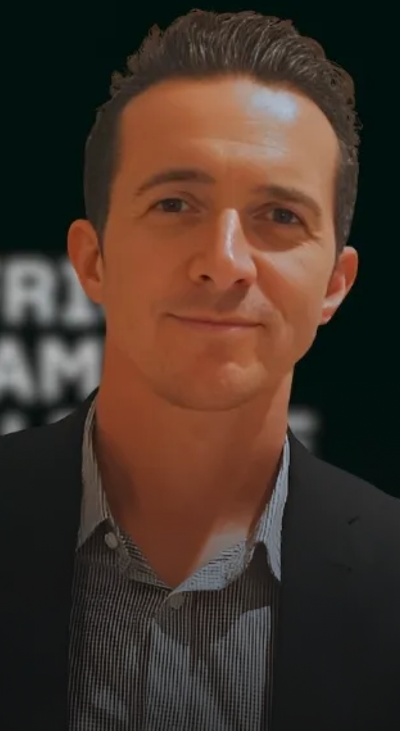

We are home for distinguished global leaders and world-class organisations shaping tomorrow's most important opportunities through trusted connections, meaningful collaboration and decisive action. As of our 2025 & 2026 flagship conferences, they include:

Counder Calendar

At Counder, we know true progress thrives at the intersection of trusted connections, groundbreaking insights, and immersive experiences. As part of our Counder Calendar, we curate an exclusive schedule of curated events and engagements — from intimate dinners to front row seats at epic events — designed to foster meaningful connections and collaboration in unique, memorable settings.

Our Collective fosters exclusive collaborations, strategic co-investments, and impactful outcomes. Whether you're a visionary investor seeking new frontiers or a leading pioneer in your field, Counder creates experiences for visionary leaders to connect, exchange & collaborate.

PFL Johannesburg with Siya Kolisi & Jessica Motaung

Africa Collective Lunch at Art Basel with Kola Aina

Counder Dinner Berlin with André Kanya

PFL Dinner Cape Town with Donn Davis

PFL Cape Town with Nicholas Ackerman & Bastian Gotter

Business Leader Evening with Karin Pickard Louis & Dr Michael Louis

Counder Dinner Cologne with Dirk Ströer, Constantin Lennert & Marco Neuhaus

Counder Dinner Düsseldorf with Thilo von Selchow

Counder Dinner Berlin with Mariama Boumanjal

Champions League Cape Town with Bastian Schweinsteiger

Counder Dinner Cape Town with Tanja Werheit & Wrenelle Stander

Swiss-African Business Day with Dr. Ngozi Okonjo-Iweala

Latest on Counder

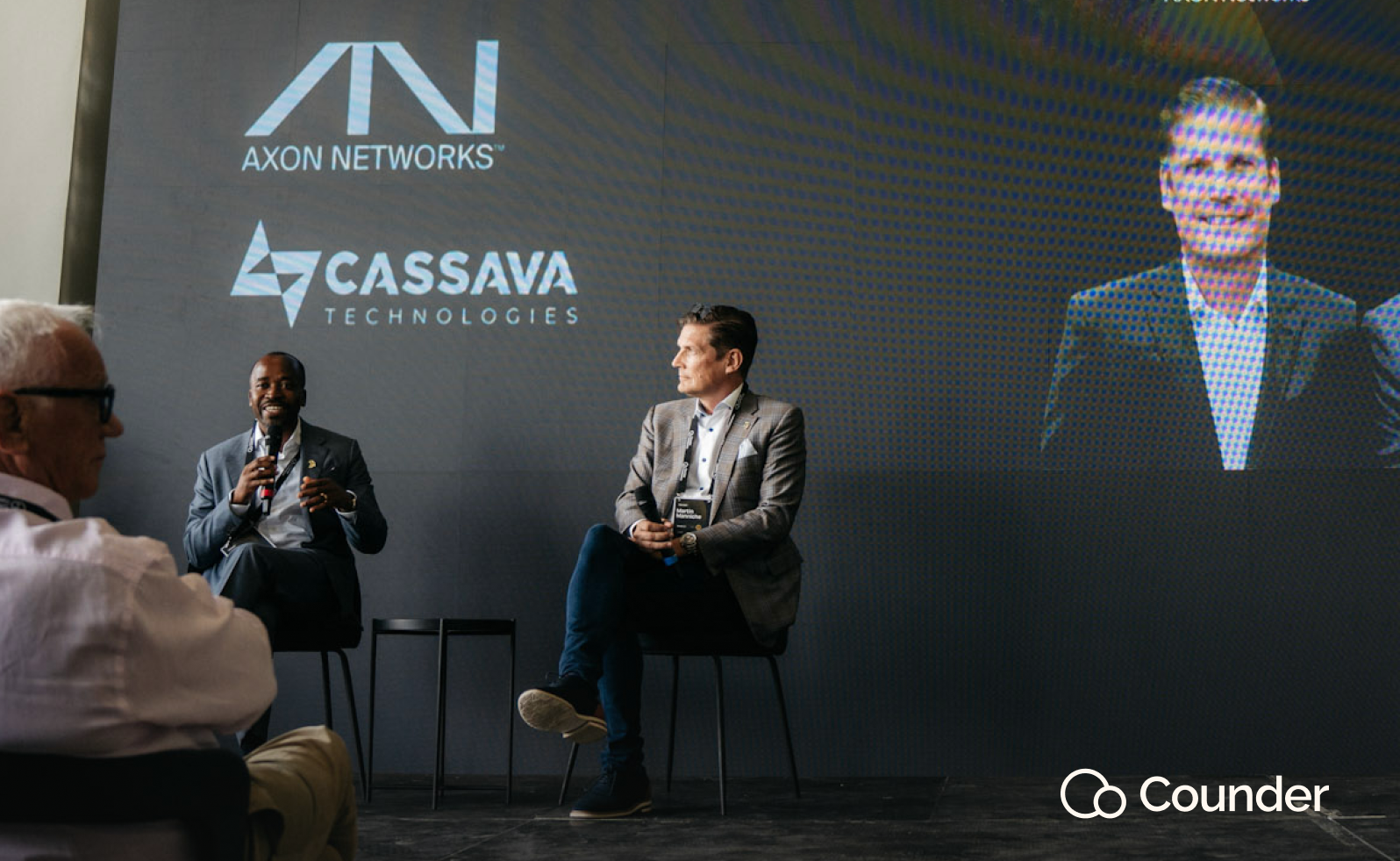

Counder Live on CNBC Africa

Counder Conference 2026 will bring 500 hand-selected global business leaders to Cape Town for a three-day gathering focused on emerging markets and international collaboration. In a recent CNBC Africa interview, Counder co-founder Michel Weiss explained how the invitation-only conference creates trusted environments for meaningful conversations between international investors and African leaders, designed to foster partnerships and drive foreign direct investment. The event positions Cape Town as a world-class destination for global business discussions, featuring prominent figures from finance, technology, and sports investment sectors.

Counder Live on CNBC Africa ▼

AXON Networks and Cassava Technologies unveil Africa’s first AI infrastructure platform at Counder Conference 2026 ▼

TechCabal covers the strategic partnership between AXON Networks and Cassava Technologies, unveiled at Counder Conference 2026 in Cape Town, to build Africa's first AI-driven Operator-as-a-Service platform — combining AXON's software-driven networking with Cassava's pan-African infrastructure to transform the continent's fibre footprint into an intelligent digital platform.

Read Full Article

Counder Conference 2026 brings African legends, OpenAI and 500 global leaders to Cape Town ▼

Business Insider Africa reports on Counder Conference 2026, which brought 500 global leaders from 30+ countries to Cape Town for three days of candid discussions under Chatham House Rules. With Africa playing a central role, the event featured 18 Knowledge Partners including OpenAI, Cassava Technologies, and Investec leading sessions on AI, crypto, sports investing, and urban infrastructure — alongside South African icons Dr Christo Wiese, Yvonne Chaka Chaka, and Benni McCarthy.

Read Full Article

Cape Town Emerges as Destination for Global Conversations as 500 Leaders Convene for Counder Conference ▼

CNBC Africa highlights Counder Conference 2026 as a milestone for Cape Town's emergence as a destination for global business dialogue. The three-day event brought together 500 investors, family office principals, and C-suite executives from 30+ countries, with 18 Knowledge Partners — including OpenAI, Investec, The Stack Group, and Ringier — leading breakout sessions on AI, African tech, wealth management, and digital markets.

Read Full Article

Middle East emerges as focus at Counder’s Global Leadership Summit in South Africa ▼

Counder Conference 2026, taking place January 27-29 in Cape Town, will spotlight the Middle East's growing influence on global commerce and investment. The invite-only summit brings together 500 leaders — including family office principals, institutional investors, and venture capitalists from across continents — to explore the region's transformation from energy powerhouse to diversified innovation hub. Through curated roundtables and expert-led sessions, confirmed participants from the UAE, Egypt, India, Germany, USA, and South Africa will examine opportunities in fintech, renewable energy, cross-border collaboration, and many more, fostering the trusted partnerships and co-investment opportunities that Counder's leadership network is designed to engineer.

Read Full Article

How Cape Town Is Attracting Global Family Offices, Sports Investors, and Leading Art Collectors After South Africa's G20 Year ▼

Business Insider Africa examines how Counder Conference 2026 is positioning Cape Town as a global investment hub, attracting family offices, sports investors, and tech leaders this January. The article profiles Counder's invite-only model bringing 500 visionary leaders per region, with Founding Partners Michel Weiss and Leonard Stiegeler highlighting Cape Town's strategic advantages and perfect January timing. The piece emphasizes Counder's outcomes-first format featuring expert-guided breakouts, with Knowledge Partners including TLcom Capital, Norrsken22, and Investec. Counder Conference establishes Cape Town as the natural stage for trusted connections that translate into tangible collaborations and co-investments.

Read Full Article

Counder Conference Returns for 2026 Edition ▼

Counder Conference 2026 will bring 500 hand-selected global business leaders to Cape Town for a three-day gathering focused on emerging markets and international collaboration. In a recent CNBC Africa interview, Counder co-founder Michel Weiss explained how the invitation-only conference creates trusted environments for meaningful conversations between international investors and African leaders, designed to foster partnerships and drive foreign direct investment. The event positions Cape Town as a world-class destination for global business discussions, featuring prominent figures from finance, technology, and sports investment sectors.

Read Full Article

Inside the Cape Town gathering in January, where OpenAI, sports legends, and multi-billion dollar funds are betting on what's next ▼

This feature looks inside Counder Conference 2026, a three-day gathering where OpenAI, global family offices, category-defining operators, academics, and African leaders convene at a moment of major global shifts. It highlights Counder’s invite-only, complimentary model and referral-led curation, designed to bring together decision-makers with real allocation and collaboration capacity. The piece also explains how the conference works in practice: an unconference format under Chatham House Rules, with 18 intimate breakout sessions and curated Cape Town excursions that create space for trusted, peer-to-peer exchange. Across the programme, world-class organisations support sessions as knowledge partners, spanning sectors from AI and finance to media, sports, and infrastructure — all anchored to the theme of tomorrow’s most important opportunities.

Read Full Article

How Counder Conference is convening Silicon Valley, African tech leaders & global family offices for meaningful collaboration ▼

TechCabal explores how Counder Conference is bringing together Silicon Valley tech investors, African operators, and international family offices for meaningful collaboration in Cape Town. The feature profiles Founding Partners Michel Weiss and Leonard Stiegeler, who explain Counder's unconference format—intimate breakouts under Chatham House rules that enable candid dialogue on tomorrow's most important opportunities. Highlighting the conference's invite-only model with 500 curated global leaders organised as Top-100 cohorts per region, the article examines how Cape Town naturally integrates Africa into global investment conversations. With Knowledge Partners including TLcom Capital, Norrsken22, Investec, and Ringier, Counder Conference positions trusted connections as the foundation for cross-border collaboration and co-investment opportunities.

Read Full Article

Africa’s tech transformation draws global leaders to Cape Town as Counder Conference 2026 leverages South Africa’s G20 momentum ▼

TechCabal reports that Counder Conference 2026 has unveiled African-focused themes and confirmed high-profile attendees for its January 27-29 gathering in Cape Town, strategically timed to follow South Africa's G20 presidency. The invitation-only event will welcome 500 global leaders to explore Africa's rising tech space and importance through select themes. Confirmed African participants include Louis Norval, Michael Jordaan, Kola Aina, and Sherine Kabesh, alongside international leaders like Anuradha Das Mathur and Sudeep Ramnani. Hosted at prestigious venues including the Norval Foundation and German Residence, the Conference aims to sustain momentum from South Africa's global recognition by creating trusted spaces for private sector collaboration and cross-border partnerships.

Read Full Article

Counder Conference 2026 Unveils African Themes & Attendees Following South Africa’s G20 Presidency ▼

CNBC Africa reports that Counder Conference 2026 has unveiled African-focused themes and confirmed high-profile attendees for its January 27-29 gathering in Cape Town, strategically timed to follow South Africa's G20 presidency. The invitation-only event will welcome 500 global leaders to explore Africa's rising importance through themes like "South Africa: At a Crossroads," "Nigeria: Bold and Untapped," and "The Continent's Century." Confirmed African participants include Louis Norval, Michael Jordaan, Kola Aina, and Sherine Kabesh, alongside international leaders like Anuradha Das Mathur and Sudeep Ramnani. Hosted at prestigious venues including the Norval Foundation and German Residence, the Conference aims to sustain momentum from South Africa's global recognition by creating trusted spaces for private sector collaboration and cross-border partnerships.

Read Full Article

Counder Conference Confirms High-Profile Venues & Attendees ▼

CNBC Africa covered Counder Conference 2025, which took place January 29-31 in Cape Town with 500 high-profile global and African investors participating. The exclusive gathering featured prestigious venues including the German Consul's official residence, the Norval Foundation, and The Lawns overlooking the Atlantic Ocean. Notable attendees included Shola Akinlade (Paystack co-founder), Dr. Michael Jordaan (Montegray Capital CEO), Tom Boardman (African Rainbow Capital), Kuseni Dlamini (Massmart Chairman), and representatives from international family offices and funds like Norrsken22, TLCom, and Grey Heron Venture Partners, creating a platform for transformative collaboration between global capital and Africa's investment opportunities.

Read Full Article

Counder to Bring Global and African Leaders to Cape Town After G20 Presidency ▼

BusinessTech Africa reports that Counder Conference 2026 has announced continent-focused programming and confirmed themes for its January 27-29 summit in Cape Town, capitalising on momentum from South Africa's G20 leadership role. The exclusive gathering will bring together 500 invitation-only leaders to examine Africa's emerging influence through sessions on "South Africa: At a Crossroads," "Nigeria: Bold and Untapped," and "The Continent's Century." Leading African figures confirmed include Louis Norval, Michael Jordaan, Kola Aina, and Sherine Kabesh, joined by global executives such as Anuradha Das Mathur and Sudeep Ramnani. Set across premium Cape Town locations including the Norval Foundation and German Residence, the Conference seeks to build on South Africa's enhanced international profile by facilitating high-level private sector dialogue and intercontinental business partnerships.

Read Full Article

Business Insider Africa partners with Counder for their 2026 global leadership conference in Cape Town ▼

Business Insider Africa announces its partnership as official media partner for Counder Conference 2026, taking place January 27-29 in Cape Town as South Africa's G20 presidency reinforces the continent's geo-political importance. The curated assembly will gather 500 invite-only global leaders to explore Africa-focused themes including "South Africa: At a Crossroads," "Nigeria: Bold and Untapped," "Egypt: Past Meets Future," and "The Continent's Century." Confirmed African participants include Louis Norval, Michael Jordaan, Joshin Raghubar, Basetsana Kumalo, Kola Aina, Sherine Kabesh, and James Mwangi, joined by international leaders such as Anuradha Das Mathur, Dr Oliver Merkel, Sudeep Ramnani, and Andrew Stewart. Business Insider Africa CEO Katharina Link will attend as part of the strategic partnership, which reflects the Conference's commitment to amplifying African voices in global business dialogue.

Read Full Article

Counder Conference 2025 Set For Cape Town ▼

CNBC Africa reported on Counder Conference 2025, which took place January 29-31 in Cape Town. The exclusive three-day event brought together global family offices, institutional investors, and regional experts to explore investment opportunities across key African growth sectors including consumer retail, real estate, hospitality, and technology. Hosted in partnership with Carlsquare (a leading European M&A investment bank), the conference featured focused sector discussions, networking experiences, and deep-dive sessions designed to facilitate face-to-face connections between global capital and Africa's investment potential in Cape Town's world-class setting.

Read Full Article

Global and African Leaders Head to Cape Town For Counder Conference 2026 ▼

Zawya announces that Counder Conference 2026 has revealed Africa-centric programming and secured prominent leaders for its January 27-29 convening in Cape Town, leveraging the aftermath of South Africa's G20 presidency. The curated assembly will gather 500 by-invitation leaders to assess Africa's growing global relevance through discussions on "South Africa: At a Crossroads," "Nigeria: Bold and Untapped," and "The Continent's Century." Key African representatives include Louis Norval, Michael Jordaan, Kola Aina, and Sherine Kabesh, complemented by international executives including Anuradha Das Mathur and Sudeep Ramnani.

Read Full ArticleTo serve our Collective, Counder is structured around four pillars.

Counder Conference is the gathering of visionary investors, industry-leading experts, and world-class organisations to explore tomorrow’s most important opportunities together. Sharing experiences and insights with hand-selected global leaders in a stunning, natural environment creates a uniquely trusted, connected, and collaborative exchange.

Learn more

Counder Calendar is our exclusive schedule of curated events and engagements designed to unite visionary leaders in shared experiences, dialogue, and discovery. Events range from private member-only gatherings to strategic collaborations with select world-class partners, fostering connections that drive meaningful insights and opportunities

Be Part of Counder

Counder Context is a distinctive curation of insights crafted by and for visionary leaders, designed to provide the right context to explore tomorrow's most important opportunities. Through expert reports, selected newsletters and more, Counder Context keeps our members ahead of emerging trends and market shifts.

Be Part of Counder

Counder Connect is our evolving digital platform that seamlessly facilitates ongoing introductions and value creation amongst members and partners. Beyond events, Counder Connect aims to ensure continuous engagement and collaboration for those who choose to participate.

Be Part of CounderWhy Counder?

'Counder' [kown•duh] is a name that embodies the spirit of the visionary leadership network it represents.

It draws from a blend of words that capture its essence: a Collective of Funders, Founders, and Leaders, building new Connections and offering Counters to outdated perspectives. At its core, Counder is about embracing emerging trends and markets together — and sparking trusted Collaborations driving meaningful, forward-looking impact in the world.

Our Values

At Counder we forge high-trust relationships, co-create groundbreaking insights and drive purposeful, profitable global innovation through...

Trust

Integrity and openness define our high-trust environment. We carefully select members and partners to foster authentic dialogue, effective collaboration, and meaningful outcomes.

Experiences

Our flagship Cape Town conference and curated gatherings blend inspiring locations with sophisticated programming, deepening connections and catalysing transformative outcomes.

Collaboration

Collaboration bridges industries, bringing visionary leaders together to ignite fresh ideas, generate shared insights, and seize tomorrow's opportunities together.

Innovation

Curiosity and bold thinking fuel our innovative spirit. By spotlighting breakthrough ideas and enabling experimentation, we empower our collective to actively shape meaningful progress.

Still have questions?

Do you have questions about Counder, our conference or other aspects? Would you like to become a sponsoring partner or want to find out more about what we do? We are here to help. See our FAQs or send us a message. Our team is looking forward to receiving your message and will be in touch.

Send Us a Message

Invite